“there is a demonstrated phenomenon for small stocks as a group to outperform large stocks by roughly 5 percentage points a year in the last 50 years.”

DFA Founder Rex Sinquefield, in the Oct. 23rd, 1982 edition of the New York Times

In 1975, John C. Bogle founded mutual fund giant Vanguard. Its flagship product, now called the Vanguard 500 Fund (VFINX), was the world’s first consumer index fund. Its objective was simple – to capture the return of the S&P 500 index, less a small amount in fees.

In 1981, David Booth and Rex Sinquefield founded another mutual fund company, Dimensional Fund Advisors (DFA). DFA was based on another simple concept – that smaller stocks would outperform larger ones. Their flagship product, The DFA Small Cap Fund (DFSCX, later re-branded the “Micro Cap Portfolio”) was born.

Booth and Sinquefield’s idea made intuitive sense: smaller companies would probably be riskier than large ones, and that higher risk should be rewarded with higher returns. Small stocks also had “room to grow” and reward their investors with exponential price increases.

These theories were backed with empirical data – research had begun to show that small caps had in fact outperformed large caps over the preceding decades, with higher risk.

In some ways, Vanguard and DFA’s flagship funds were polar opposites – the 500 Fund held the largest 80% of the market, while DFAs Small Cap fund bet on the smallest 10% of stocks. They were, however, similar in that they eschewed stock picking, and attempted to passively track predefined segments of the market.

After almost 40 years, this post asks the question: “Which strategy should investors have followed?”

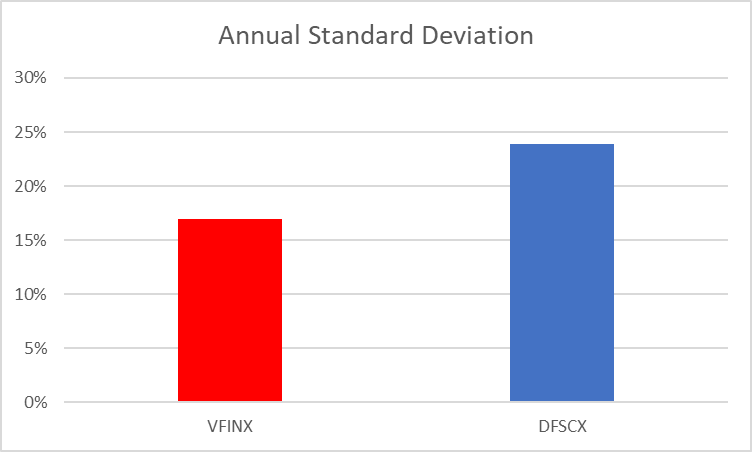

Let’s first look at risk. The DFA fund is unequivocally riskier that Vanguard’s. Compare the volatility of the two funds:

The standard deviation of the DFA fund is 24%, versus 17% for the Vanguard fund – an almost 50% difference. But did this increased risk translate into increased returns?

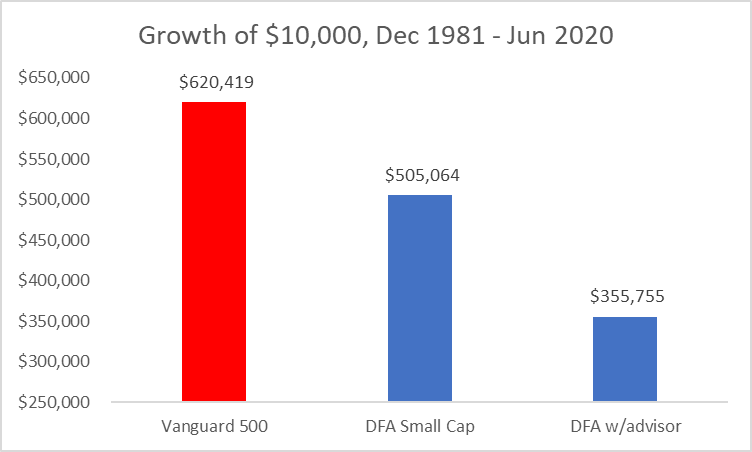

When looking at DFA results, the advisor fee customers pay must be considered, since you can’t own DFA funds directly. Here’s the 38.5-year growth of these two flagship funds, with and without a 1% DFA advisor fee. Source: Morningstar.

The Vanguard flagship grew at 11.4% per year, while the DFA flagship grew at 11.1%, or 10.1% after advisor fees. Vanguard investors wound up with at least an extra $115k on a $10k investment.

So, what happened? DFA investors got the higher risk they expected, just not the higher returns.

Part of the answer is cost. The DFA fund’s expense ratio is 0.5% higher than Vanguard’s. But ER isn’t the only fund cost. Trading small cap stocks, which tend to be illiquid and have higher bid/ask spreads, is more expensive than sticking with Bogle’s large cap strategy. And small cap funds must trade frequently, selling any stock that grows too large to meet its portfolio criteria. These expenses aren’t reflected in the ER, but they do reduce returns. They also make the fund tax inefficient.

This is why academic research tends to uncover small cap outperformance that investors are unlikely to see – that research fails to include advisor fees, or expense ratios, or transaction costs, or taxes.

Beyond cost, we might also revisit the assumption that small caps will outperform large caps significantly. Consider this chart of VFINX vs DFSCX prices since 1981 (Vanguard is red, DFA is blue):

Let me break it down for you.

Small and large caps had similar performance during the 1980s, with a slight edge to large caps. In the 1990s, as tech stocks like Cisco and Microsoft exploded, large caps outperformed. During the 2000s small caps clawed their way back, and by the 2009 Great Recession the two funds had identical long-term returns.

Small stocks were on track to handily outperform large during the 2010s…until 2019, when large caps caught up, and long-term performance was again identical. Small caps then proceeded to fall apart during the covid-19 crash of 2020.

Over the next 40 years, I expect small caps to slightly outperform large caps “on paper”, and underperform them in real world funds. The wise investor will hold both parts of the market – through a single, tax efficient total market index fund from Vanguard or similar.

Booth and Sinquefield’s experiment with small caps made them very rich men. Their customers, not so much. Bogle never made enough money have an elite business school renamed in his honor or take over a state. The fruits of his labor, as the chart above shows, went to Vanguard owners/customers. Consider carefully who you trust your life savings with.

[…] but DFA had only one stock “dimension” between its founding in 1981 in 1992 – company size. See my last post for details. The Fama/French paper showed how adding a second filter, for value stocks, might […]

LikeLike

Ok, but one problem with your analysis. Research since Fama’s 1992 paper has shown that a small cap portfolio only outperforms when small cap growth stocks are excluded. When small cap growth is included, the small cap premium disappears completely. This is why DFA’s pure small cap index has underperformed traditional market cap weighted index funds.

LikeLike

But in real world results, small growth funds have outperformed everything else. Look at Vanguard’s. F&F’s made up dataset just has no relationship to real world fund returns.

LikeLike